Regular Loans

If the purpose of the loan is personal (not business-related)

ATM Loan

- Offered to government employees with permanent/regular employment status and who have no pending Administrative Case

- Up to P 500,000 Loanable amount

- Payable up to five (5) years, monthly payment through ATM

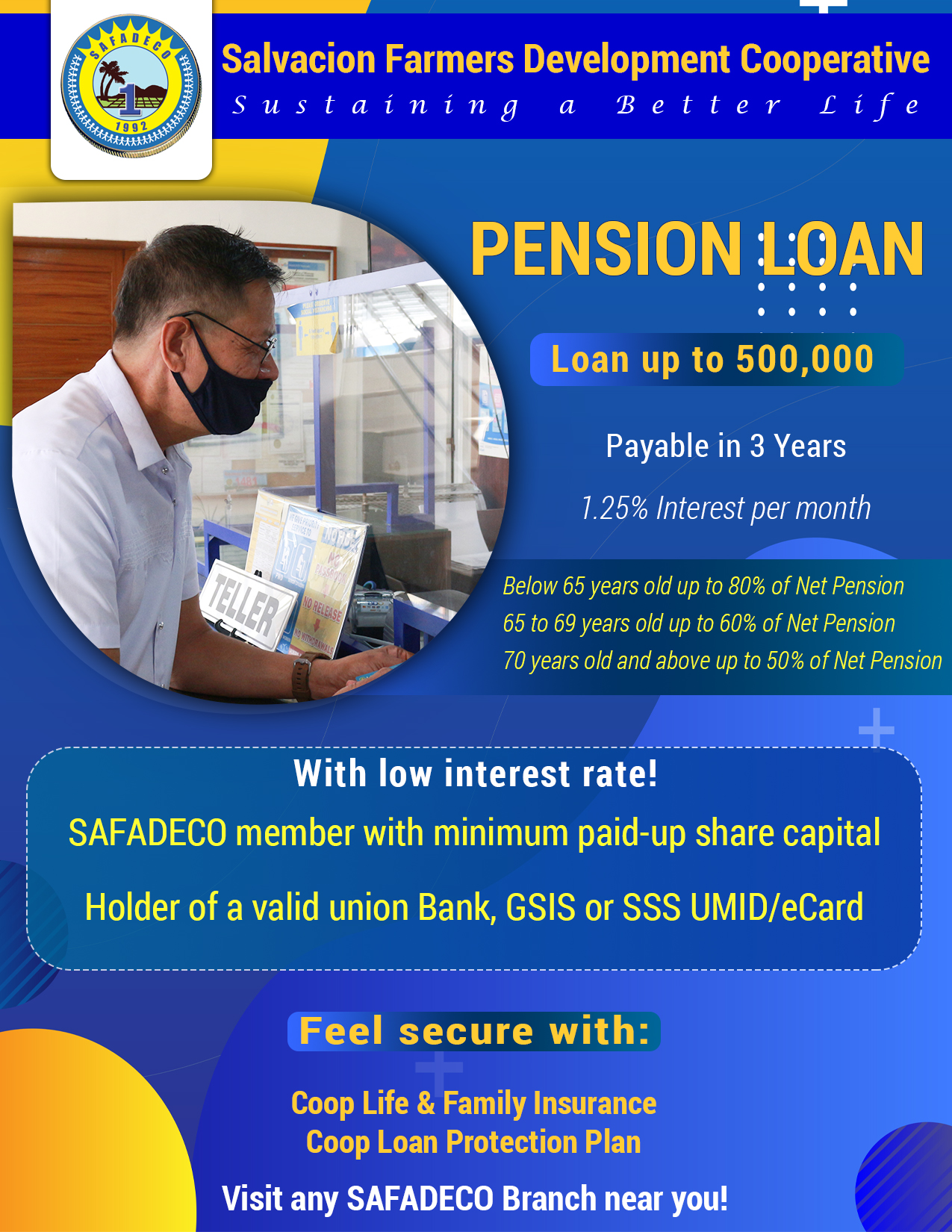

Pensioner Loan

- Offered to SSS, GSIS (and others) Pensioners

- Up to P 500,000 Loanable amount

- Payable up to three (3) years, monthly mode of payment through ATM

Furniture, Appliances, Mobility, and Electronics

- Offered to all qualified SAFADECO Members

- Loanable amount for Classified members is up to P30,000 pesos worth of a gadget or appliance

- Payable up to 1 year

- No down payment needed

- Interest rate is 1.25% per month or 15% per annum

TINDAHAN Loan

- The maximum loan amount is based on members’ classification.

- Offered to Classified Members:

- Bronze – up to 2,000

- Silver – up to 3,000

- Gold – up to 4,000

- Platinum – up to 5,000

- Up to 5,000 worth of groceries

- Fast loan approval and release

- Interest on the loan is 2% per month.

- Payable for one (1) month.

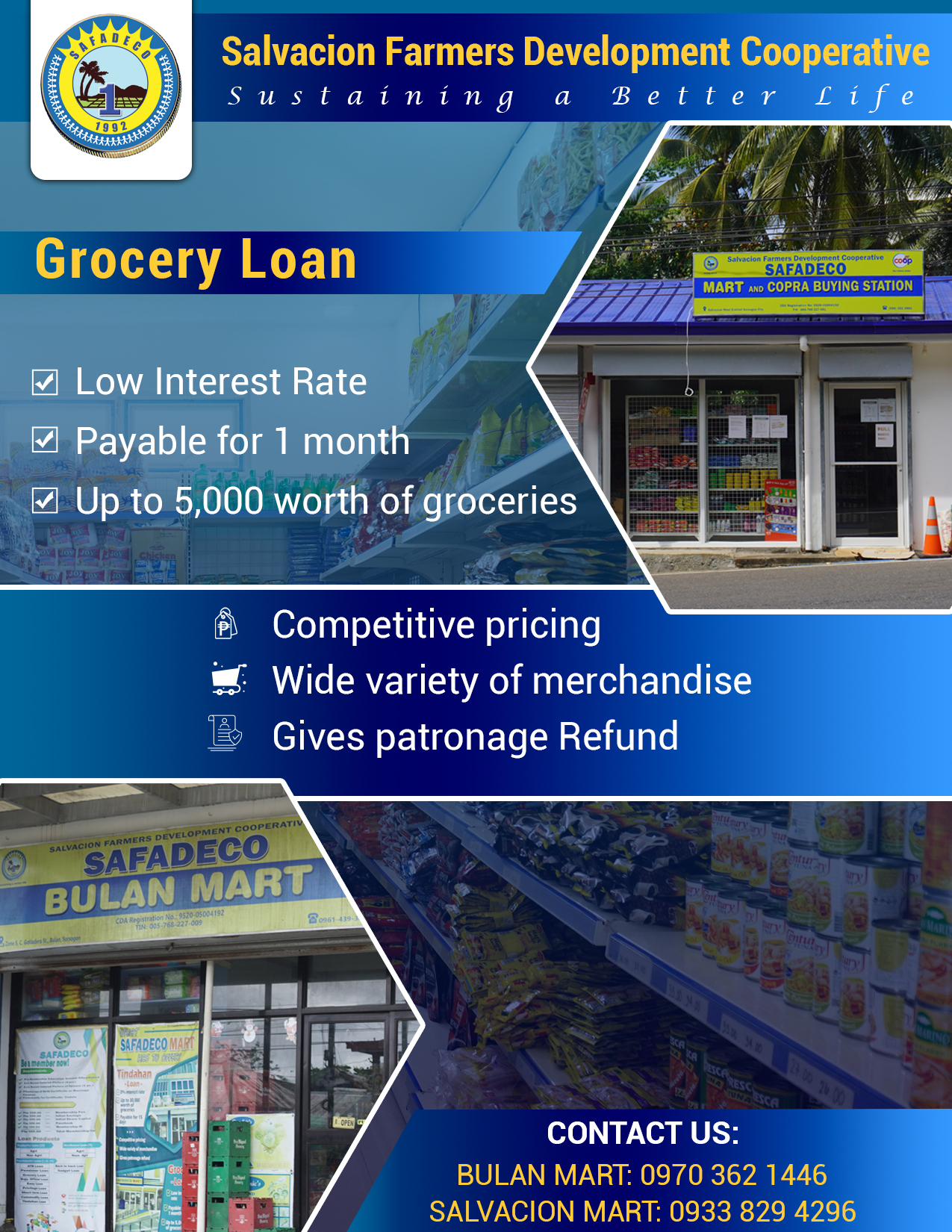

GROCERY Loan

- The maximum loan amount is based on members’ classification.

- Offered to Classified Members:

- Bronze – up to 2,000

- Silver – up to 3,000

- Gold – up to 4,000

- Platinum – up to 5,000

- Up to 5,000 worth of groceries

- Fast loan approval and release

- Interest on the loan is 2% per month.

- Payable for one (1) month.

GOVERNMENT OFFICIALS’ APPOINTED AND ELECTED SALARY LOAN

- Offered to at least 2 officials per barangay

- The loanable amount is 80% of the monthly honorarium

- Payable until the last month of the term

- Loan is up to 90% of the monthly honorarium of the officials and workers

- The maximum term of the loan shall be three (3) years

- Interest rate is 1.4%

Privilege Loan

- Offered to Classified Members:

- Bronze – up to 2,000

- Silver – up to 3,000

- Gold – up to 4,000

- Platinum – up to 5,000

- Fast loan approval and release

- Interest on the loan is 2% per month

- The term of the loan is one (1) month

- Mode of payment is lump sum/monthly

Easy Loan

- Offered to all qualified SAFADECO Members

- Loanable amount is equivalent to the paid-up share capital

- Payable up to 3 years

- Fast loan approval and release

- No other requirements and co-makers needed

Productive Loan

If the purpose of loan is for agricultural/non-agricultural business (Additional capital/start-ups)

- Offered to all qualified SAFADECO Members

- Loanable amount is equivalent to the paid-up share capital

- Payable up to 3 years

- Fast loan approval and release

- No other requirements and co-makers needed

Back-to-Back Loan

- Offered to Members with Time Deposit in SAFADECO

- Loanable amount is equivalent to 80% of the existing Time Deposit

- Loan term is the same as the term of the Time Deposit

- Interest rate is 1% per month or 12% per annum

- Monthly or lump sum mode of payment

SAFADECO CHATTEL ASSET LOAN

- Loanable Amount: Up to 50%

- Interest Rate: 15% per annum

- Term: Up to 5 years.

- Service Fee: shall be pre-deducted from the approved amount.

- Savings and Share Capital Retention – 2 % each

- Mode of Payment: Monthly payments via Post-Dated Checks (PDCs)

- Collateral Security: Original Certificate of Registration with mortgage

- Loan Renewal: Eligible upon payment of at least 25%

SAFADECO REAL ESTATE COLLATERAL LOAN (SAREC)

LOAN FEATURES

- Security: Real estate or Lot Owned by the borrower

- Loanable Amount: Up to 80%

- Interest Rate: 13% per annum

- Term: Up to 5 years.

- Service Fee: shall be pre-deducted from the approved amount

- Mode of Payment: Monthly payments through Post-Dated Checks (PDCs).

- Collateral Security: Original title with mortgage

- Loan Renewal: Eligible upon payment of at least 25%

SAFADECO PALAY PRODUCTION LOAN

- Loan Amount: Based on the farm budget plan or a minimum of 30,000

- Minimum landholding of 0.5 hectare and up to 5 hectares

- Interest Rate: 18% per annum

- Service Fee: 2%

- Repayment Terms: Payment schedules aligned with the rice harvest cycle, with a maximum of 6 months.

- Mode of Payment: Lump sum

- Interest Deduction: Upfront deduction of interest from the loan amount

- Share Capital and Savings: Mandatory contributions may be paid monthly

- Collateral: None

- CLPP: 1.1 x Loan Amount x Loan Term (months) / 1000

- Insurance: Free crop insurance provided by PCIC

- Use of Funds: Strictly for rice production activities